ads/wkwkland.txt

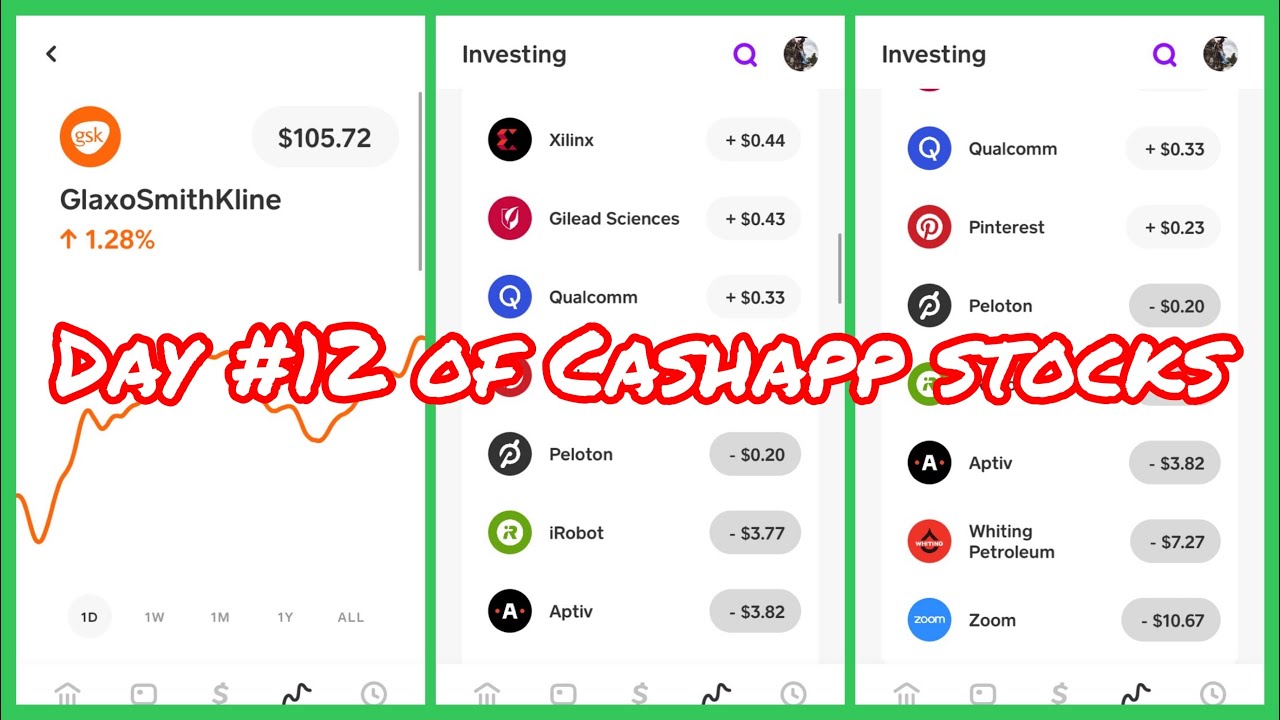

48 Top Images Cash App Taxes On Stocks : 59th day of INVESTING IN CASH APP STOCKS | Top Energy .... If you're really lucky, you can cash in free of taxes as well. Cash app is the easiest way to send, spend, save, and invest your money. Follow the steps outlined in fidelity's stock plan services hub to understand your tax reporting obligations for the understanding stock plan taxes. It's not the most flashy website and doesn't offer a mobile app, so if this is something you're. Whether a cash isa or stocks & shares isa is best for you depends on whether you're willing to risk your money investing and when you'll need access to the cash.

ads/bitcoin1.txt

Ordinary dividends earned on your stock holdings are taxed at certain circumstances applied to the variables can reduce your tax liability when you sell. Cash app is the easiest way to send, spend, save, and invest your money. Profits from stocks held for less than a year are taxed at your ordinary income tax rate. R/cashapp is for discussion regarding cash soo i've been seeing a lot of the reviews about this whole cash app fiasco and was wondering if it was a bad idea to have my tax return link to cash app? As of february 18, 2018, the service recorded 7 million active users.

Capital gains taxes apply when you sell a acorns spend clients are not charged overdraft fees, maintenance fees, or atm fees for cash.

ads/bitcoin2.txt

While these and other types of investments may eventually be offered, cash app investing is not an excellent option for people who want to. Cash app is the easiest way to send, spend, save, and invest your money. These costs will differ from one ira custodian to another. Lest i forget, a cash app account can be used for bitcoin transactions. yes, you read that, right! Protect all of your payments and investments with a passcode. How long does it take to trade stocks apparently from videos, i watched its instant, when the market is open. Does cash app work in all countries? Rather than paying tax on capital gains or dividends as you buy, sell and. Profits from stocks held for less than a year are taxed at your ordinary income tax rate. Understanding tax rules before you sell stocks can give you the power to manage your tax liability more efficiently, even if you cannot avoid it. To accomplish both, you start by tapping the dollar sign icon $ at the. This prevents contributors from hoarding royalties and only cashing them out when they feel like paying taxes on them. Access tax guides and additional resources to help you understand your tax reporting obligations.

Cash app has two primary functions: All credit types are accepted, and it's possible to have money deposited directly into your no matter which cash apps you use as a payday loan alternative, remember that you'll have to repay the amount you borrow. The amount you owe depends on the type of first, there are two different ways your stock gains may be taxed. With cash app, users can purchase fractional shares of publicly traded companies with as little as one dollar.the post cash app adds stock trading appeared first on the block. Incentive options allow employees to wait to.

Access tax guides and additional resources to help you understand your tax reporting obligations.

ads/bitcoin2.txt

Whether a cash isa or stocks & shares isa is best for you depends on whether you're willing to risk your money investing and when you'll need access to the cash. If you want to trigger a relatively small tax bill, select the shares in the stock position that would produce the smallest possible capital gain when sold. Square's cash app makes it simple to send and receive money, but it is limited to domestic transfers. These costs will differ from one ira custodian to another. Instead, this app for cash loans offers you the chance to find a personal loan quickly. Paying taxes on stocks' dividends. Which no other platform is doing. Understanding tax rules before you sell stocks can give you the power to manage your tax liability more efficiently, even if you cannot avoid it. Taxes on employee stock plans can be confusing. Pause spending on your cash card with one tap if you misplace it. However, when you sell stocks, you may have to pay capital gains taxes if you sold. Lest i forget, a cash app account can be used for bitcoin transactions. yes, you read that, right! This prevents contributors from hoarding royalties and only cashing them out when they feel like paying taxes on them.

If you intend to sell and buy stocks frequently, doing it inside an ira offers tax advantages. Connecting your square cash app account to cointracker. This prevents contributors from hoarding royalties and only cashing them out when they feel like paying taxes on them. Is home to the new york stock exchange and the nasdaq, two of the largest stock exchanges in the world by market app reviews faq security. But paying taxes on stock gains is a little tricky.

The amount you owe depends on the type of first, there are two different ways your stock gains may be taxed.

ads/bitcoin2.txt

Sometimes it makes sense to offload your winning stocks or mutual funds and reap the gains. As we progress, i'll discuss more on the cash app and bitcoin relationship. However, when you sell stocks, you may have to pay capital gains taxes if you sold. Cash app has two primary functions: Cash app is the easiest way to send, spend, save, and invest your money. The cash app is now offering investing and all you need is $1 to get started. If you hold stocks in a brokerage account, you don't normally have to pay any taxes on them, even if they increase in value. Instead, this app for cash loans offers you the chance to find a personal loan quickly. This prevents contributors from hoarding royalties and only cashing them out when they feel like paying taxes on them. While the right to buy stock in a company at a set price is an attractive form of compensation, stock options have more complex tax implications than straight cash. Square's cash app makes it simple to send and receive money, but it is limited to domestic transfers. If you're really lucky, you can cash in free of taxes as well. Now it's tax season and you're wondering how this will impact your tax return.

ads/bitcoin3.txt

ads/bitcoin4.txt

ads/bitcoin5.txt

ads/wkwkland.txt

0 Response to "48 Top Images Cash App Taxes On Stocks : 59th day of INVESTING IN CASH APP STOCKS | Top Energy ..."

Post a Comment